Shipping parcels to Canada

In Canada, the sustained growth of e-commerce is redefining delivery expectations. In this fast-changing environment, e-consumers are looking for solutions that are reliable, practical and adapted to their lifestyles. It's against this backdrop that Colissimo, with its expertise in parcel delivery, offers services such as Delivered Duty Paid (DDP) that meet market demands and support your development in the Canadian market.

Identity card and basic information about Canada

- Country code : CA

- Capital : Ottawa

- Languages : French, english

- Population : 41 million residents

- Currency : Canadian dollar

Public holidays 2025 :

1st january, 18 april, 1st july, 4 august, 1st and 30 september, 13 october, 11 november, 25 and 26 december

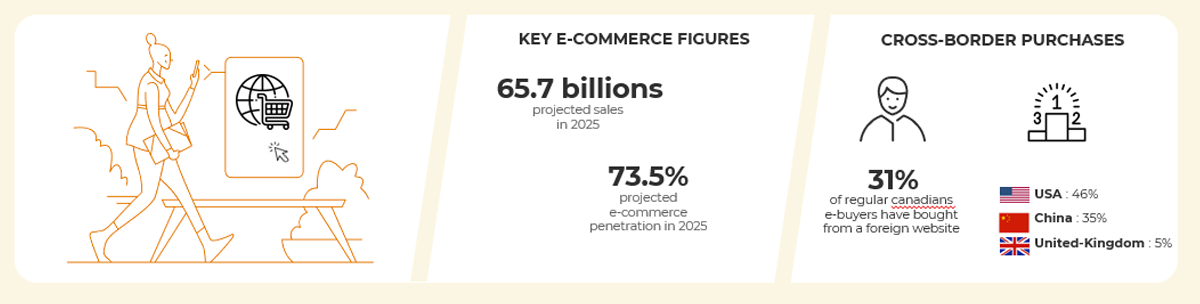

The Canadian e-commerce market: key figures and trends

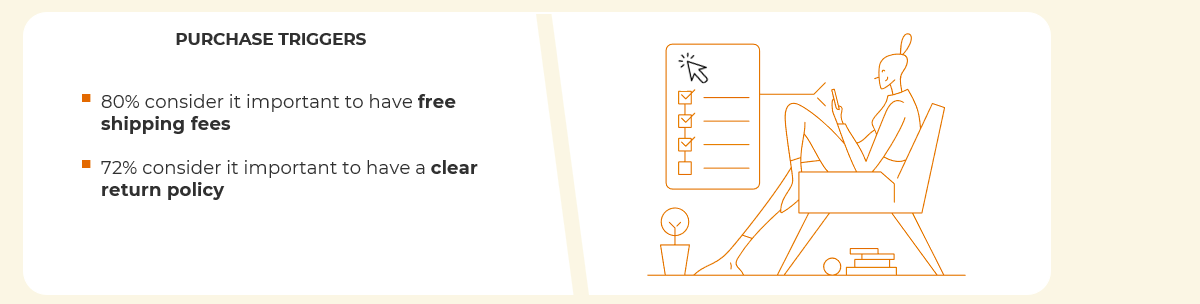

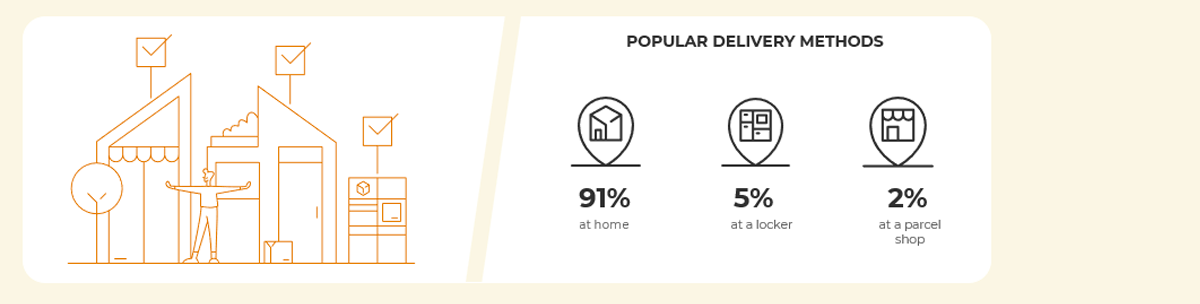

Buying behaviour of Canadian e-buyers: the keys to success

Send your parcels to Canada with Colissimo

Delivery options available :

Option(s) :

- Ad valorem compensation

- Option DDP (operated by Colissimo with a dedicated last-mile partner)

Delivery partners and integrated services :

CANADA POST :

- Offers : Home delivery with signature

- Tracking : Yes, from deposit to delivery

- Instance : Yes, 15 business days

- Saturday delivery: No

- Proof of delivery : No

- Mode of transport : road

- From D+4

- Delivery time commitment for Colissimo Domicile

- Tariff zone : 5

- Maximum weight (machine-operated): 30kg

- Maximum length (machine-readable) : 1 m

- Max layout L + W + H (non mechanisable) : 1,50 m

- Transport regulations :

Dangerous goods prohibited (ICAO, IATA). Contact your sales representative for more information.

CUSTOMS FORMALITIES

- Customs documents:

+ 4 copies of form CN23,

+ 2 copies of the commercial or pro forma invoice.

To benefit from the partial or total exemption from customs duties provided for in the CETA trade agreement between the EU and Canada, proof of EU preferential origin must be provided by the exporter via the Declaration of Origin on Invoice (DOF) for amounts up to €6,000, and via Registered Exporter status for amounts over €6,000.

There is a trade agreement between the European Union and CANADA. To benefit from the partial or total exemption from customs duties provided for in the CETA trade agreement between the EU and CANADA, proof of EU preferential origin must be provided by the exporter via the Declaration of Origin on Invoice (DOF) for amounts up to €6,000, and via Registered Exporter status for amounts above €6,000.

For more information on CANADA's import rates by product - Special restrictions:

- The international shipment of sensitive and/or strategic products is controlled. Ensure that the goods you wish to ship to this destination are not controlled under the Dual-Use Goods Regulations (products that can be used for both civilian and military purposes). For more information, visit the official website of the Dual-Use Goods Service.

- The combined shipment of battery-powered electrical/electronic devices with liquids, aerosols or gels (LAG) is no longer permitted in international air mail traffic. It is MANDATORY to separate the goods and make two separate shipments.

- Goods prohibited from import:

Alcoholic beverages, unless they are addressed to a provincial liquor, agricultural and pharmaceutical board or corporation without a certificate, licence or prescription; clothing intended for sale without a licence; charcuterie, cheese, foie gras, chemical products, perfumes. - Tax threshold:

Application of duties and taxes for any shipment with a market value greater than or equal to CAD 20.

The above lists are not exhaustive and are subject to change. We advise you to consult the websites of the customs authorities of the destination countries.

Ready to develop your e-commerce business in Canada?

To find out more, contact your usual sales contact.

Not yet a customer? Fill in our contact form to be put in touch with an expert.

This content may be of interest to you:

Read >

Read >