Shipping parcels to Australia

In response to the growing demand from Australian e-consumers, who are increasingly sensitive to speed and flexibility, Colissimo offers solutions designed to meet new uses, such as home delivery with signature or the Returns offer. By guaranteeing a seamless experience, these services enable e-tailers to respond perfectly to consumer needs and expectations, such as the Delivered Duty Paid (DDP) option.

Identity card and basic information about Australia

- Country code: AU

- Capital : Camberra

- Language : english

- Population : 27,2 million residents

- Currency : Australian dollar

Public holidays 2025 :

1sy and 27 january, 18, 21 and 25 april, 25 and 26 december

The Australian e-commerce market: key figures and trends

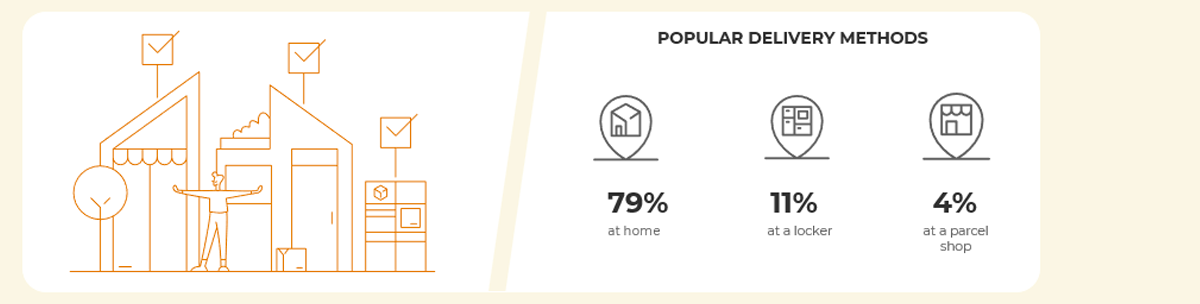

Buying behaviour of Australian e-buyers: the keys to success

Send your parcels to Australia with Colissimo

Delivery options available :

- Colissimo International home delivery – with signature

- Colissimo International Return (from Australia to France)

Option(s) :

Delivery partners and integrated services :

AUSTRALIA POST :

- Offers : Home delivery with signature

- Tracking : Yes, from deposit to delivery

- Instance : Yes, 7 business days

- Saturday delivery: No

- Proof of delivery : No

- Mode of transport : plane

- From D+5

- Delivery time commitment for Colissimo Domicile

- Tariff zone : 5

- Maximum weight (machine-operated): 30kg

- Maximum length (machine-readable) : 1 m

- Max layout L + W + H (non mechanisable) : 1,50 m

- Transport regulations :

Dangerous goods prohibited (ICAO, IATA). Contact your sales representative for more information.

CUSTOMS FORMALITIES

- Customs documents:

+ 4 copies of form CN23,

+ 2 copies of the commercial or pro forma invoice. - Special restrictions:

- Animals, plants and unprocessed derivatives are subject to complex phytosanitary legislation. More than 150 agricultural products are subject to import licences and very restrictive quarantine measures. Packaging and pallets must be accompanied by a fumigation certificate. Certain goods are subject to quotas or restrictions, including cheese, tobacco, pharmaceutical products and medicines. For more information, visit the Australian Customs website.

- The international shipment of sensitive and/or strategic products is controlled. Ensure that the goods you wish to ship to this destination are not controlled under the Dual-Use Goods Regulations (products that can be used for both civilian and military purposes). For more information, visit the official website of the Dual-Use Goods Service.

- The combined shipment of battery-powered electrical/electronic devices with liquids, aerosols or gels (LAG) is no longer permitted in international air mail traffic. It is MANDATORY to separate the goods and make two separate shipments.

- Goods prohibited from import:

Refer to the section on specific restrictions - Tax threshold:

Duties and taxes apply to all shipments of goods valued at over AUD 1,000, or the equivalent of USD 638. GST is payable on all goods (AUD 0+) sold by merchants who ship items to Australia with a value exceeding AUD 75,000 per year.

The above lists are not exhaustive and are subject to change. We advise you to consult the websites of the customs authorities of the destination countries.

Ready to develop your e-commerce business in Australia?

To find out more, contact your usual sales contact.

Not yet a customer? Fill in our contact form to be put in touch with an expert.

This content may be of interest to you:

Read >

Read >