Shipping parcels to the UK

Despite its exit from the European Union, the United Kingdom remains an important e-commerce market for French companies. British consumers are savvy online shoppers, with specific delivery expectations and a strong interest in international brands. This page provides information on UK shopping habits, post-Brexit customs formalities and Colissimo solutions, in particular our DDP (Delivered Duty Paid) service, which simplifies the shopping experience by taking care of import duties and taxes, a major asset in removing disincentives to purchase.

Identity card and essential information about the United Kingdom

- Country code : GB

- Capital : London

- Languages : English

- Population : 67 886 004 residents

- Currency : pound

Public holidays 2025 :

1 January, 29 March, 1 April, 6 May, 27 May, 26 August, 25 December, 26 December

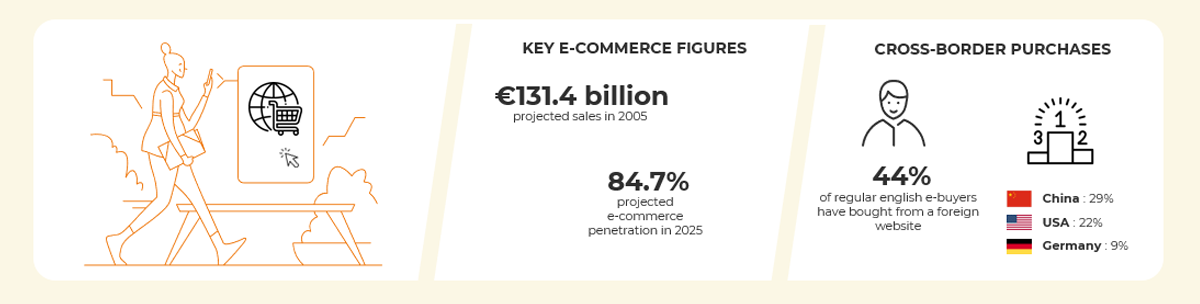

The UK e-commerce market: key figures and trends

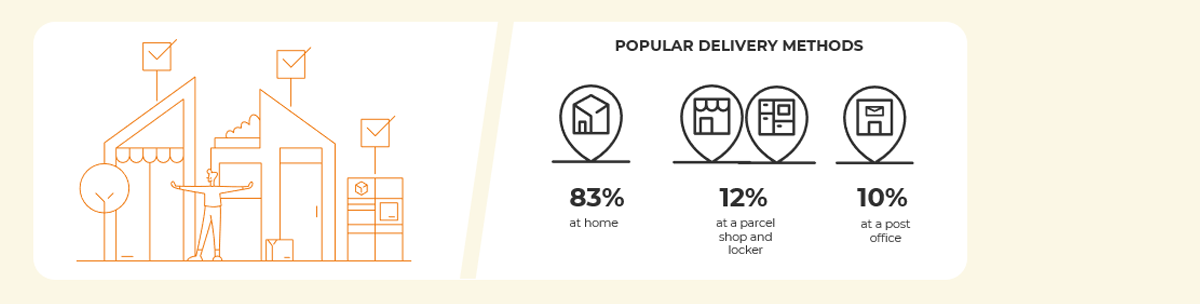

Buying behaviour of e-buyers in the UK: the keys to success

Send your parcels to the UK with Colissimo

Delivery options available :

Option(s) :

- Ad valorem compensation (Colissimo home with signature, point retrait and return)

- DDP (Operated by Colissimo with a dedicated last mile partner)

Delivery partners and integrated services :

Parcel Force :

- Offers : Domicile with signature and Return from the UK (excluding islands) to France

- Tracking : Yes, from deposit to delivery

- Interactive notification service : No

- Instance: Yes

- Delivery time: 15 days

- Time the parcel is held pending payment of customs fees (value > £135): 21 days

- Saturday delivery : No

- Proof of delivery : No

- Mode of transport : road

- From D+3

- Delivery time Commitment to delivery times by Colissimo Domicile

- Tariff zone : 2

- Maximum weight (machine-operated): 30kg

- Maximum length (machine-operated) : 1 m

- Max layout L + W + H (non mechanisable) : 1,50 m

- Transport regulations : Dangerous goods authorised under the ADR can only be transported with the approval of our safety experts.

Consult your sales contact to find out more

CUSTOMS FORMALITIES

- Customes documents :

+ 4 copies of form CN23, + 2 copies of the commercial or pro forma invoice.

There is a trade agreement between the European Union and the UNITED KINGDOM. For more information on UK import rates by product: https://trade.ec.europa.eu/access-to-markets/fr/ - Specific restrictions :

- Sensitive or excise goods must be accompanied by specific documents.

- The international shipment of sensitive and/or strategic products is controlled. Ensure that the goods you wish to ship to this destination are not controlled under the Dual-Use Goods Regulations (products that can be used for both civilian and military purposes). For more information, visit the official website of the Dual-Use Goods Service.

- Goods prohibited from import :

Wine, animal products, plants, vegetable products. - Tax threshold :

- Local VAT on sales <£135 is payable by the shipper directly to UK Customs: compulsory registration with HMRC

- VAT and customs duties on sales >£135 are payable on delivery by the buyer.

EXCEPT if DDP option chosen or Colissimo re-invoices these costs to the sender. - Notification process for sales <£135 & >£135

The above lists are not exhaustive and are subject to change. You are advised to consult the websites of the customs authorities in the destination countries.

Ready to develop your e-commerce business in the UK?

To find out more, contact your usual sales contact.

Not yet a customer? Fill in our contact form to be put in touch with an expert.

This content may be of interest to you:

Read >

Read >