Are you ready for Brexit ?

Description

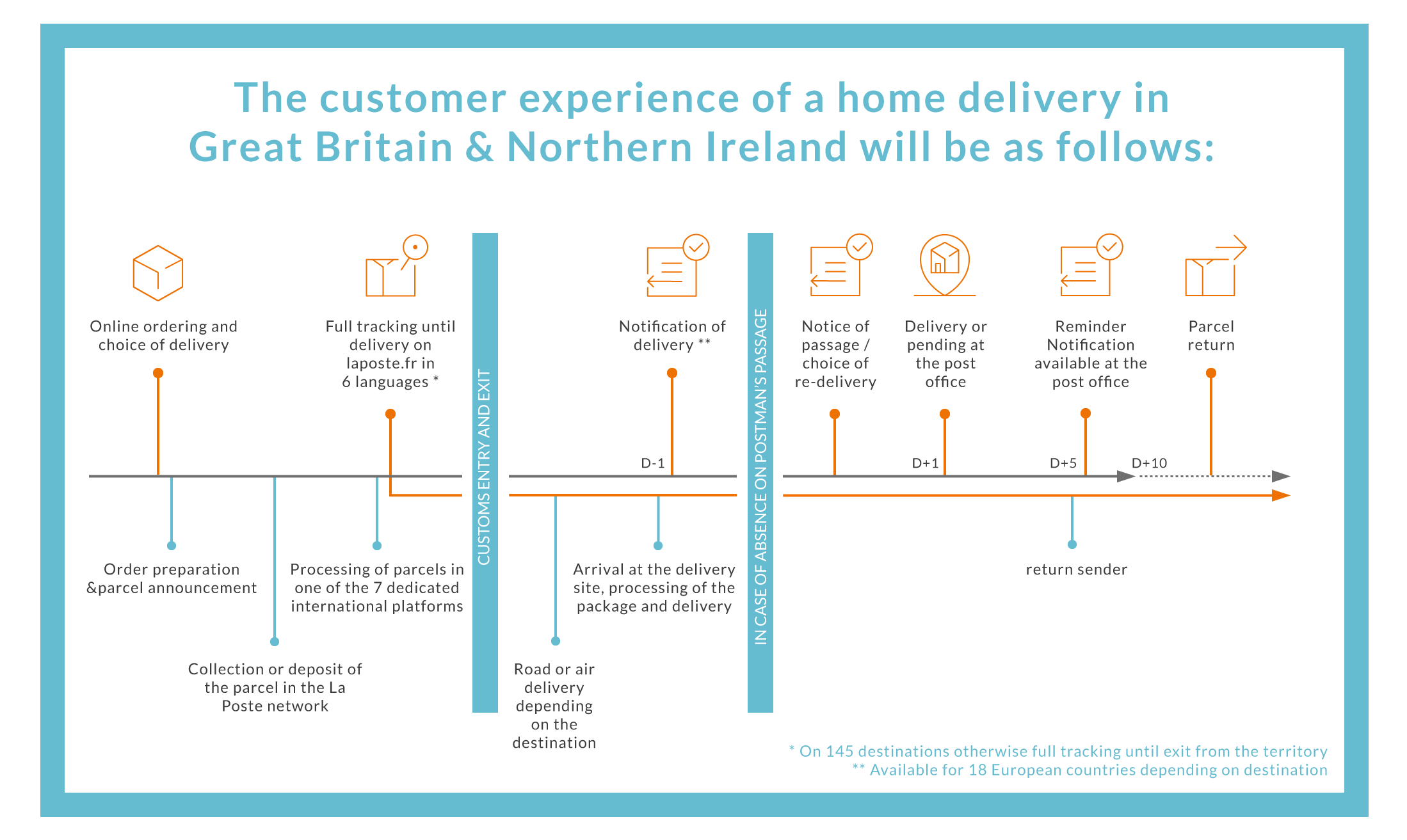

The official exit of Great Britain (England, Scotland, Wales) and Northern Ireland from the European Union is set for 31 December 2020.

On that date, Great Britain and Northern Ireland will become customs bonded destinations, which means :

1 | To respect the customs formalities applicable to destinations outside the European Union, namely:

- Register with the UK tax authorities to obtain the VAT number and pay the VAT collected at the time of ordering through the following link : https://www.gov.uk/government/publications/vat-application-for-registration-vat1

- Get a UK EORI number through the link : https://www.gov.uk/eori

- Correctly complete a CN23 customs declaration in 4 copies of which you must keep 1 copy according to the legal deadlines as fiscal proof of export.

- Enclose 2 copies of a commercial or pro forma invoice with your parcel.

- The EORI number and UK VAT number must be entered on the CN23

2 | A reform of the collection of VAT on imports into the UK :

- Commercial shipments will be taxed from £1.

- Non-commercial shipments (gifts) from one person to another will be taxed from £39.

- A new VAT collection regime will apply to commercial shipments of goods between £0 and £135. This new regime requires you to collect and then remit this VAT to the UK tax authorities, as if you had a UK business.

Removing purchase barriers by choosing the dematerialised DDP option

Simplified customs procedures :

The e-buyer receives the parcel without having to pay duties and taxes at destination.

Taxes will be collected online from your customers at the time of the trade transaction.

Média

Image

Média

Image